About Us

After over 30 years collaborating on several projects, the principals of Aurum Consultants and Integrated Computer Services have formed a new technology company together to service our collective clients and build for the future – Arctic Fox Technologies with principal headquarters in Forest Hill, Maryland.

Our focus has always been managing large volumes of data, building access to information through state-of-the-art web and mobile applications and creating value insight through client dashboards and portals.

Our deep understanding predictive science allows for our team of data scientists to build models and scores in finance, healthcare, telecom and banking to evaluate and predict behavior and performance

Our Team

The best talent for the best result

Larry Dukes

Larry is the founder of several successful entrepreneurial startups, providing subject matter and technical solutions in healthcare, finance, banking, and telecom. He has expertise in scoring models and predictive analytics measuring customer behavior and other business outcomes. Larry has authored an industry-specific book on financial analytics and authored a US patent for a risk scoring system.

John Petersam

Driven by an entrepreneurial spirit, he founded Interactive Consulting Services in January 2001 and has functioning as an independent consultant ever since.

As a consultant, John has steered the IT objectives of businesses across the Medical and Education sectors and has also delivered services to various Federal agencies.

Larry Grant

For more than 30 years, Larry Grant has been a trusted advisor to C-level executives. Grant has extensive experience as a “hands on” CFO with demonstrated general management skills, extensive domestic and international finance experience including mergers and acquisitions, investor relations and corporate restructuring.

Renee Petersam

Renee has been a part of the IT industry for 30 years, starting her career as an application developer. Throughout her career, she has held various positions, including IT Director, Project Manager, Full Life-Cycle Developer, Database Analyst, Reporting Analyst, Business Analyst, and Architect, working on multiple software products and tools.

Erin Malagar

Erin joined Interactive Consulting Services, Inc. as a software developer in 2020. Over time, she has emerged as a leader and mentor and currently serves as the chief web developer for all corporate initiatives. Erin graduated Magna Cum Laude from the University of Maryland, Baltimore County with a Bachelor of Science degree in Computer Science and a minor in Entrepreneurship and Innovation.

Morgan Knox

Morgan brings experience in customer relations and project management to ensure the customer experience is outstanding. She has led critical client projects from design to integration as a leader at Red Dog Agency since 2019. Morgan is also expert in delivery systems featuring graphics and video.

Mark Ionescu

Mark has over 15 years of experience in the fields of communication and information technology. He has designed user interfaces and engagement tools for tourism, hospitality, and medical applications, among a variety of other fields.

At Arctic Fox, we begin by understanding the data sources and quality. If necessary, we will build the code to scrub or refine the data before making it available.

Our statisticians, modelers, and developers will create the code necessary for our clients desired information presentation. Often these are detailed dashboards, scores, or models.

Once data is determined “clean,” our preferred storage is cloud-based. Arctic Fox has partnered with AWS to curate and house our test/production data and development software.

Once tested and integrated, our models become part of a complex system and are used as designed to solve and answer business questions with proven quality measurements.

Approach

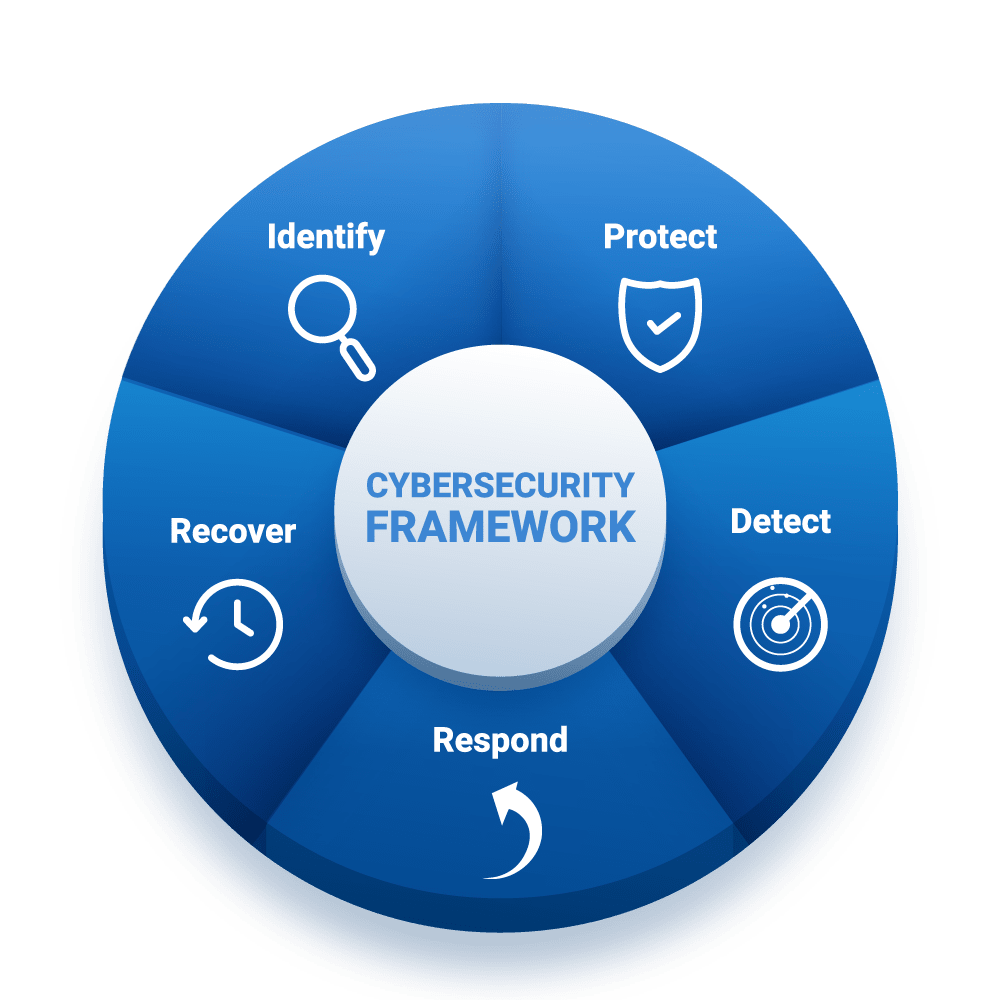

Our Approach to Data/Systems Security & Loss Prevention

Withour depth in predeictive analytics, Arctic Fox is building models and systems to help determine attacks on data in the future. Our team has done this for years building risk scores in banking, telecom, and finance.

We accomplish these efforts by determining vulnerability, analyzing behavior, predicting the propensity for attack, and determining startegies to mitigate the risk.

Our Work

Experience that counts

Client:

A North American Public Utility Company

Issue:

Need to see performance data across time and in detail to measure center and agent performance and in aggregate to measure portfolio performance for senior management.

Deliverable:

Provided senior leadership a dashboard connected to data repository of aggregated customer and center performance data in collections. Also, data warehouse strategy for Time series credit life cycle data and provided technology resources techniques in managing data and producing information.

Result:

Provided detailed data in times series repository and all rules for appending each months detail with scrubbing and aggregation standards. Prototype dashboard presented to IT personnel who elected to build production model in-house.

Client:

Medium–Sized International Manufacturing Company

Issue:

Engaged to complete IT review of European operation to identify better tracking and market analysis of sales forecasting system worldwide.

Deliverable:

Produced a report and design for combining sales and marketing data in Europe and the Pacific Rim with base data in North America. Output included a comprehensive forecasting tool tied to the budgeting and finance systems.

Result:

Integration plan for end-to-end financial forecasting to include marketing and sales data worldwide. This information was then able to produce product line budgets.

Client:

Worldwide Investment Banking Firm

Issue:

Engaged to evaluate outsourced credit and collections systems for integration in the UK.

Deliverable:

Multi-phased engagement beginning with operations review to determine the best technology fit for the organization. Next, vendors were evaluated for best in class software and technology solution , Then, played an active role in the implementation and integration of three vendor solutions.

Result:

Managed the project plan for a full technology and operations solution in the UK that included credit evaluation, customer relationship management solution and collections call center environment at two different sites in Scotland and England.

Client:

Online Business Relationship Firm

Issue:

Designer of matching algorithm and score to marry firms together at large trade shows and conferences.

Deliverable:

Determined most predictive attributes and built proprietary score to be integrated into web software. This became the “brains” of the market solution.

Result:

Provided web provider with a customer score and integration plan.

Client:

U.S. and Canadian MonoLine Credit Card Issuer (one of the largest in the world)

Issue:

Need to have expert outside opinion of loan loss forecast, risk analysis for senior management and education for director, analyst and associate level resources.

Deliverable:

Provided senior leadership at C-level round-table, produced loan loss forecast with interest and external economic data, dashboard connected to data repository, data warehouse strategy for credit life cycle data and provided risk management education for all levels of the organization.

Result:

External evaluation of all risk functions at each level of reporting. Provided outsourced education to these same levels and sat with Chief Credit Officer to help direct one of the world’s largest credit card issuers.

Client:

Large Retail Bank based in New York

Issue:

Need to produce a set of standard reporting and a data warehouse to support mortgage, student lending, DDA accounts, auto lending and credit card portfolios.

Deliverable:

Produced a series of statistical reports (deck) using SAS programming data and merging several operations/financial systems to one Oracle data warehouse.

Result:

First set of meaningful management reports on a consistent monthly basis to run the business.

Client:

Worldwide Agricultural Equipment Leasing and Financing Company

Issue:

Need to produce a score and ranking criteria for dealers. Also measurements to evaluate dealer performance. Set of delinquency reports to manage credit portfolios throughout world markets.

Deliverable:

Used scoring methodology coupled with an evaluation of data attributes to produce a Dealer/merchant score for ranking in incentives and performance.

Result:

Created a new way for management to support and evaluate their dealer relationship and build incentives and performance criteria to drive more business.

Client:

Online Retail Web Store

Issue:

Wanted to support marketing strategy of “market to one” by producing a propensity score and attached likely product to customer encounter.

Deliverable:

Took millions of customers and built a score reflective of their visits to a retail website coupled with data from several other sources.

Result:

Provided web provider with a customer score and product propensity test where the customer could be presented with specific items on each visit that matched their highest propensity to purchase.

Client:

US Retail Store (one of the top three in the country)

Issue:

Support for several credit products by providing analysis of vintages and life time purchase behavior.

Deliverable:

In depth vintage analysis reporting created along with insights provided in managing the credit portfolio.

Result:

Became a Partner in progress for the Retailer and serviced the company with consulting and reporting for almost ten years.

Client:

Quasi-Government Agency dealing with Delinquent Tax Revenue.

Issue:

Need to prioritize resources in managing $30B in tax revenue uncollected. Need to prioritize agents to seek those with the highest propensity for collection.

Deliverable:

Created a score that looked at attributes of the debt and attributes of the debtor to identify those with the highest chance of recovery.

Result:

Provided a score and a methodology for collecting by agent the delinquent portfolio.

Client:

Worldwide Pharmaceutical Company.

Issue:

Need for outcomes measurement on drugs in the areas of allergies, cardio, digestive and mental health.

Deliverable:

Tied mass marketing efforts with analysis of a loyalty based system involving a diary provided to patients and script detail provided by healthcare providers. Measurements compared the feelings of the patient to the scripts written by the provider against the advertising awareness dollars spent in a market.

Result:

Provided a testing methodology with specific outcomes measurements and the technology platform to capture data, measure it and produce meaningful management information.

Client:

National Producer of Pet Foods

Issue:

Need for analysis of coupon and card program with national grocery store chains.

Deliverable:

Created a test marrying coupon data, affinity cards and grocery store purchases to measure loyalty and velocity for the national producer.

Result:

Provided technology solution for capturing data and marrying to captured data by the grocery store chain and manufacturer.

Client:

Regional Telephone Company

Issue:

Needs to analyze market potential for instant credit and the establishment of new accounts in the cell business space.

Deliverable:

Created an instant credit function to be tested and implemented at regional/statewide venues (i.e. State Fairs in the Midwest) to create product sales and market penetration.

Result:

Provided the first portable instant credit solution to be distributed and installed in remote sites tied to credit bureaus and regional telecom company.